Important note: Some of the forms and instructions on this Web site do not reflect recent changes in Tax Department services and contact information. Use the Printer-friendly PDF link at the top of the instructions to save or print. If you find you still prefer to print your instructions, you can.

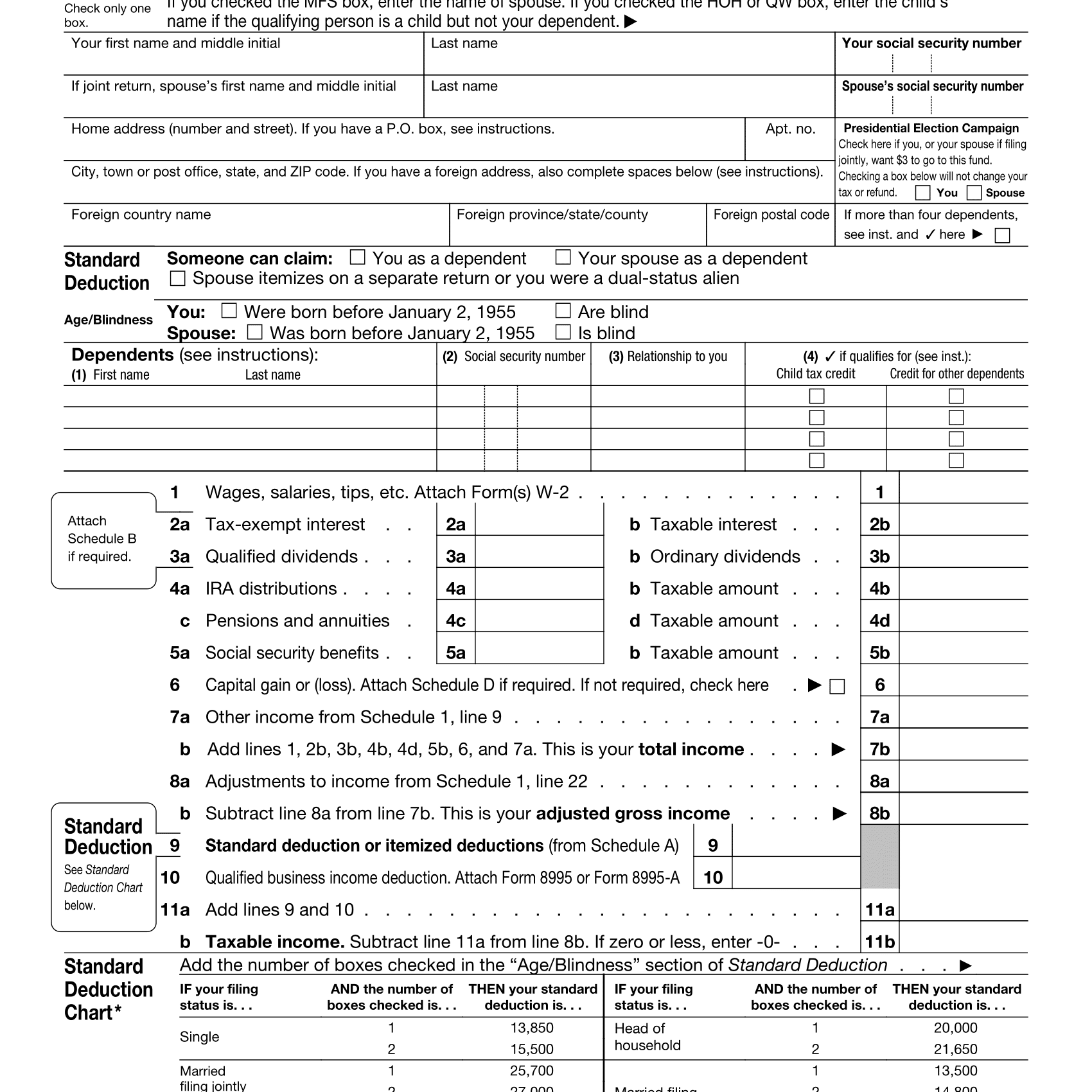

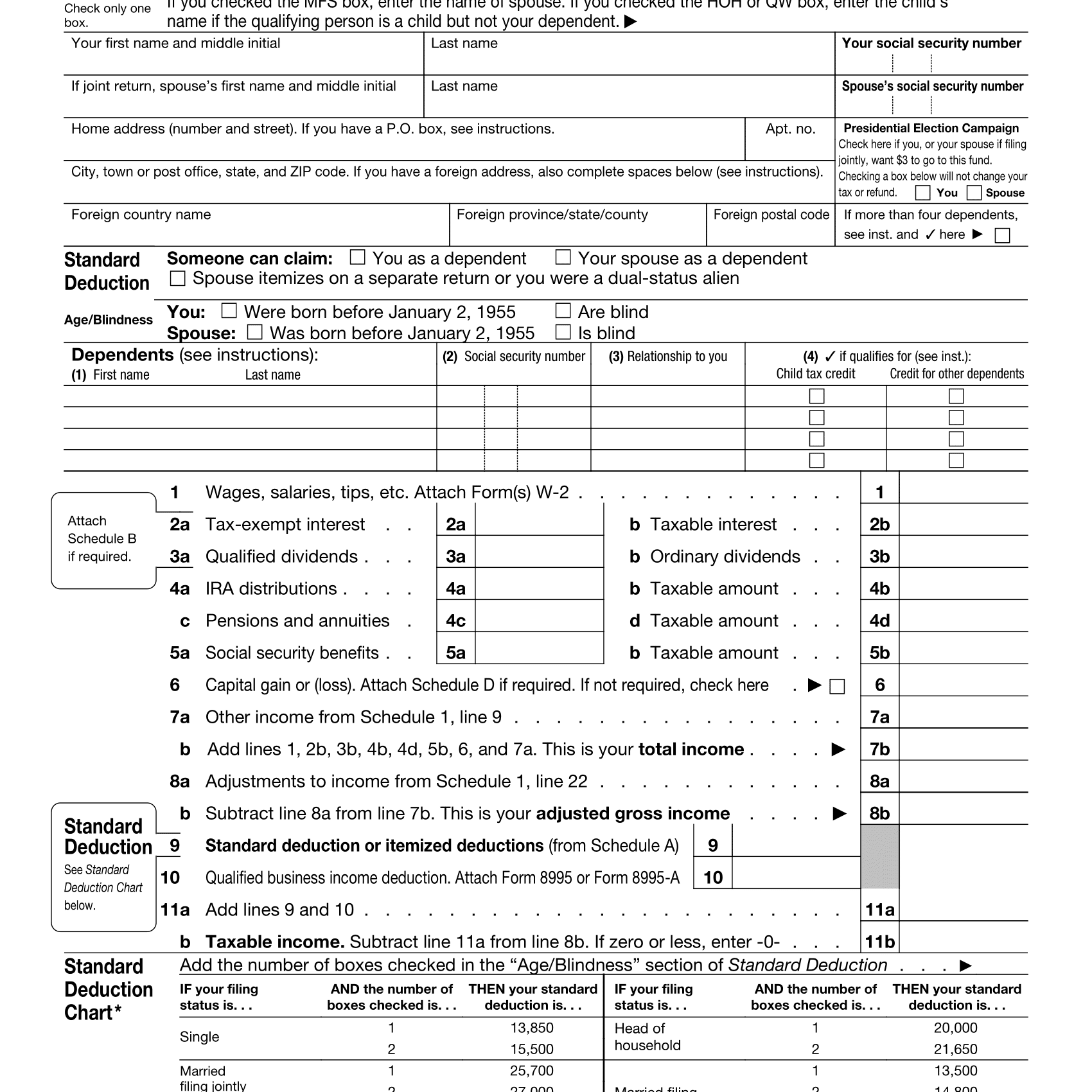

use bookmarks to navigate-the back arrow at the top left in your browser will take you back to the section you were readingĪs you use these new instructions, complete our survey to let us know what you think. find the forms and resources you need with hyperlinks-the link you select will open in a new window so you can easily return to the instructions. use CTRL + F to search for specific content in the instructions. Web instructions are more accessible, easier to understand, and easier to navigate. A change worksheet that records revisions to the spreadsheetĢ.You may notice we've turned some of our form instructions into webpages and rewritten them for plain language.  SSA-1099 input form to record Social Security benefits. 1099-R retirement input forms for up to nine payers each for a taxpayer and their spouse. 1099-DIV dividends and distributions for up to ten payers. 1099-INT interest income input forms for up to ten payers. W-2 input forms that maintain up to four employers and their spouse. A disclaimer worksheet that also includes a high-level summary. Line 44: Qualified Dividends and Capital Gain Tax Worksheetįive additional worksheets complete the tool:. Line 42: Deduction for Exemptions Worksheet. Line 40: Standard Deduction Worksheet for Dependents. Line 33: Student Loan Interest Deduction Worksheet.

SSA-1099 input form to record Social Security benefits. 1099-R retirement input forms for up to nine payers each for a taxpayer and their spouse. 1099-DIV dividends and distributions for up to ten payers. 1099-INT interest income input forms for up to ten payers. W-2 input forms that maintain up to four employers and their spouse. A disclaimer worksheet that also includes a high-level summary. Line 44: Qualified Dividends and Capital Gain Tax Worksheetįive additional worksheets complete the tool:. Line 42: Deduction for Exemptions Worksheet. Line 40: Standard Deduction Worksheet for Dependents. Line 33: Student Loan Interest Deduction Worksheet.  Lines 20a and 20b: Social Security Benefits Worksheet. Lines 16a and 16b: Simplified Method Worksheet. Line 10: State and Local Income Tax Refund Worksheet. The spreadsheet also includes several worksheets: Form 8960: Net Investment Income Tax – Individuals, Estates, and Trusts. Form 8949: Sales and Dispositions of Capital Assets. Form 8889: Health Savings Accounts (HSAs). Form 8283: Noncash Charitable Contributions. Form 6251: Alternative Minimum Tax – Individuals. Form 2441: Child and Dependent Care Expenses.

Lines 20a and 20b: Social Security Benefits Worksheet. Lines 16a and 16b: Simplified Method Worksheet. Line 10: State and Local Income Tax Refund Worksheet. The spreadsheet also includes several worksheets: Form 8960: Net Investment Income Tax – Individuals, Estates, and Trusts. Form 8949: Sales and Dispositions of Capital Assets. Form 8889: Health Savings Accounts (HSAs). Form 8283: Noncash Charitable Contributions. Form 6251: Alternative Minimum Tax – Individuals. Form 2441: Child and Dependent Care Expenses.

Form 2210: Underpayment of Estimated Tax by Individuals, Estates, and Trusts.Schedule F: Profit or Loss from Farming.Schedule E: Supplemental Income and Loss.Schedule D: Capital Gains and Losses (along with its worksheet).Schedule C: Profit or Loss from Business.Schedule B: Interest and Ordinary Dividends.Microsoft Excel spreadsheet for US Federal Income Tax Form 1040įree Federal Income Tax Form 1040 (Excel Spreadsheed)

0 kommentar(er)

0 kommentar(er)